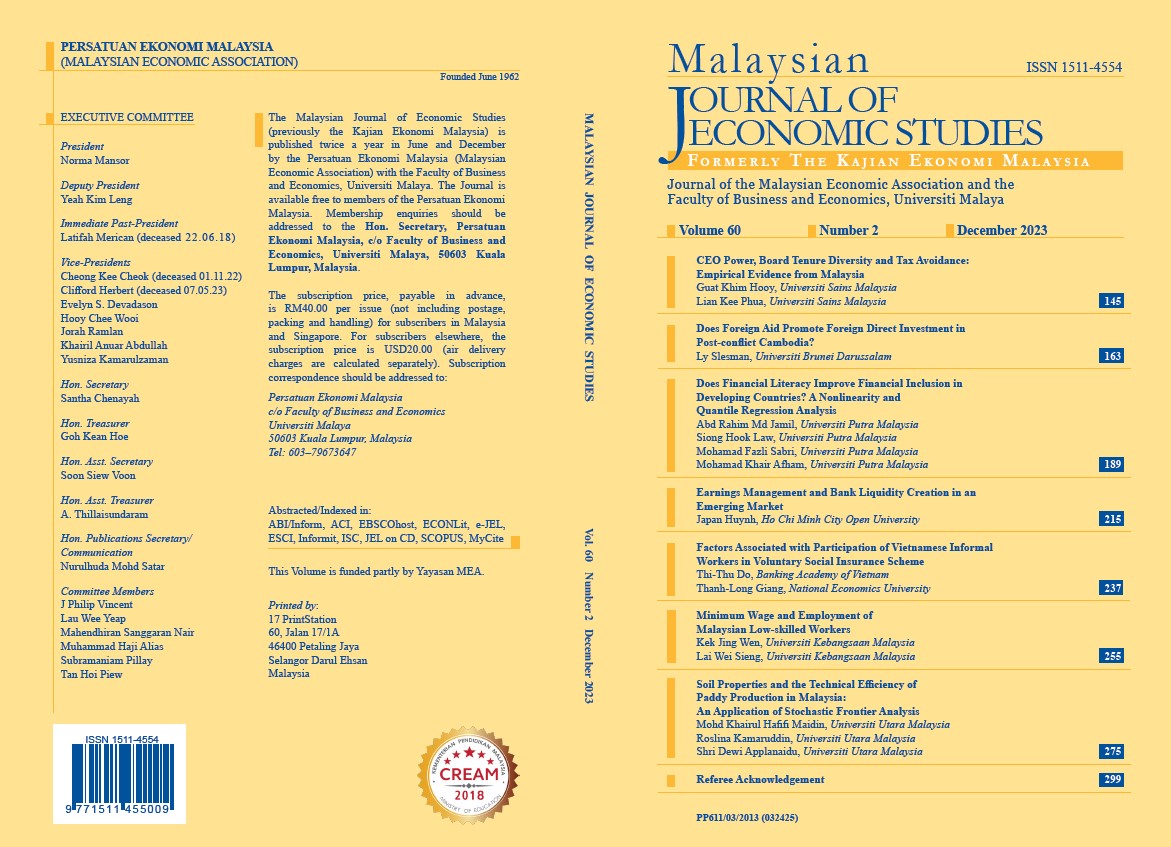

Earnings Management and Bank Liquidity Creation in an Emerging Market

DOI:

https://doi.org/10.22452/MJES.vol60no2.4Keywords:

Bank funding, bank opacity, earnings management, liquidity creationAbstract

This paper empirically examines the impact of bank earnings opacity on liquidity creation. Using a sample of commercial banks in Vietnam from 2007 to 2019, we find that more opaque banks tend to reduce liquidity creation growth. We further offer sharp evidence that the impact of earnings management on bank liquidity creation depends on bank-specific characteristics. More precisely, the negative impact of bank earnings management on banks’ core function is stronger for banks that are more poorly capitalised, less liquid, smaller and less profitable. With these findings, our work display implications on the supply-side effect (i.e., the limited access to funding of financially weak banks).

Downloads

Download data is not yet available.