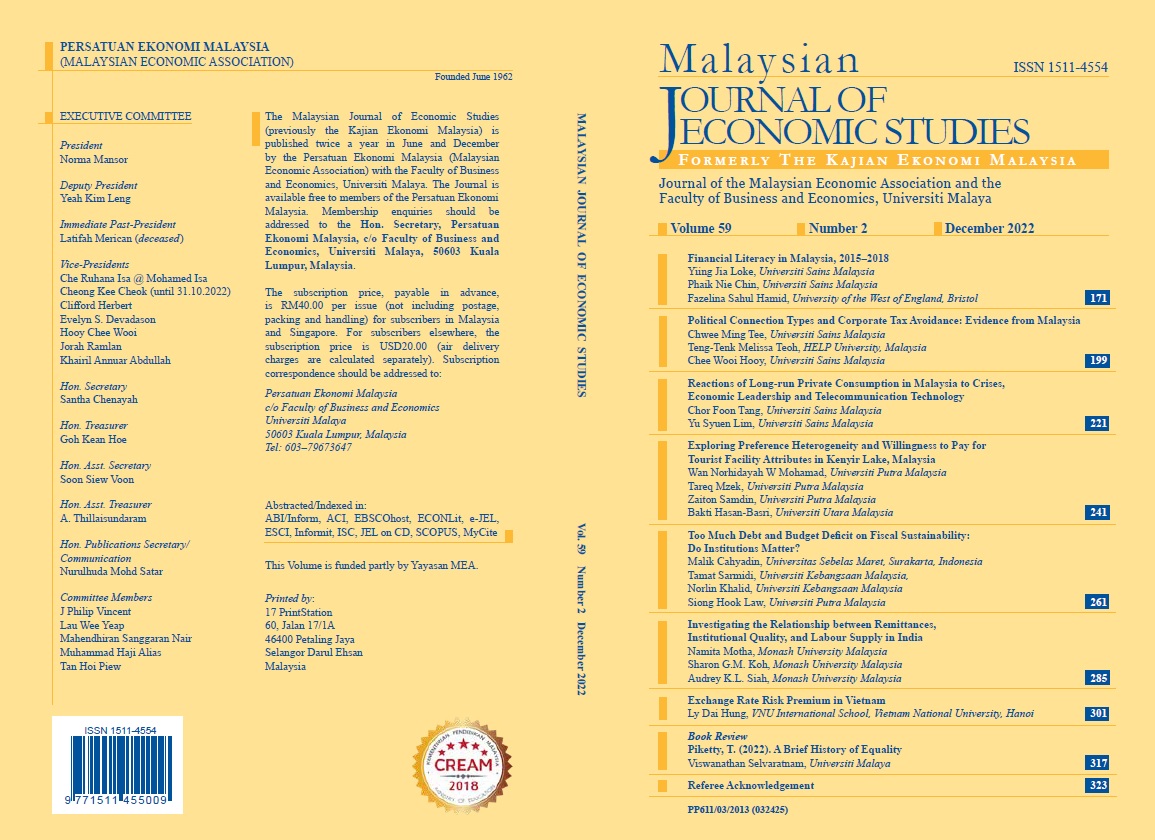

Exchange Rate Risk Premium in Vietnam

DOI:

https://doi.org/10.22452/MJES.vol59no2.7Keywords:

Exchange rate, risk premium, vector autoregression, VietnamAbstract

This study characterises the exchange rate risk premium in the context of a small open economy with a controlled floating exchange rate regime. The empirical analysis applies the time-varying coefficients Bayesian structural vector autoregressive (TVC-BSVAR) model on data from the Vietnamese economy over a sample period from February 2012 to February 2019. The evidence shows that the risk premium varies over time, and increases with inflation and foreign direct investment capital inflows, but decreases with output growth and credit growth. The TVC-BSVAR model displayed highly accurate forecasting performance, accounting for nearly 94% of risk premium in a case study using the US dollar forward selling contract.