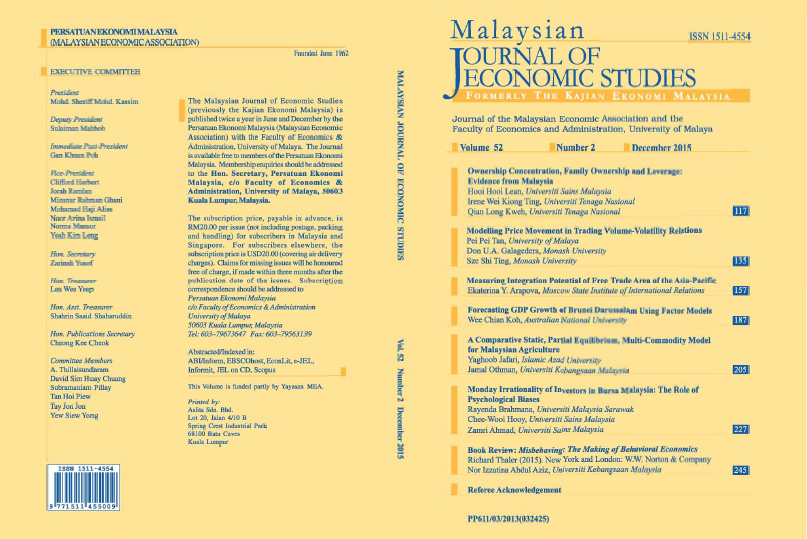

Monday irrationality of investors in Bursa Malaysia: the role of psychological biases

Keywords:

Behavioural economics, Bursa Malaysia, Monday irrationality, psychological biasesAbstract

This study aims to investigate the role of psychological biases in determining the day-of-the-week Monday irrationality in Bursa Malaysia using daily data from 1 January 1999 until 30 December 2011. First, our findings proved the existence of Monday irrationality in Bursa Malaysia. Second, our analysis found significant relationships between psychological biases and Monday irrationality. Evidence was documented through the interactive model and day-by-day model. This study enriches the behavioural finance literature by falsifying the traditional utility function model. It proves that the hedonic utility and prospect theory are applicable for the case of this study. Feelings of investors are involved in trading, and they react differently on Monday because of psychological biases. This implies that investors or fund managers can beat the market by following the cycle of calendar anomalies.