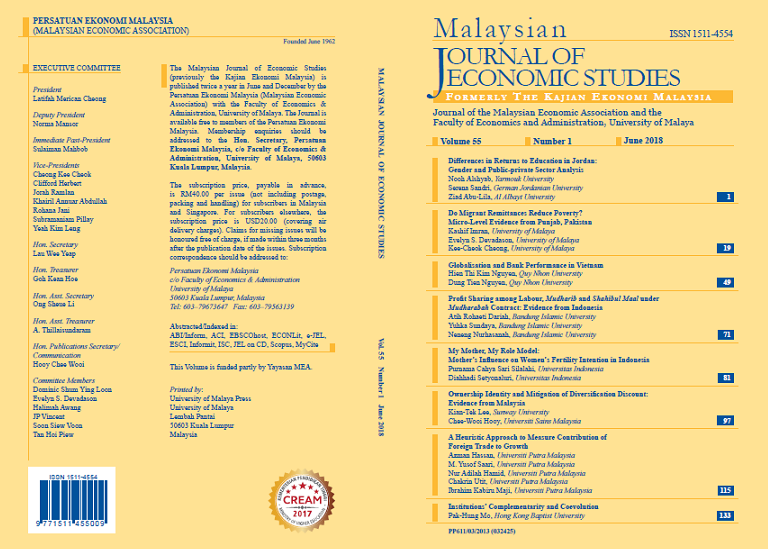

Ownership Identity and Mitigation of Diversification Discount: Evidence from Malaysia

DOI:

https://doi.org/10.22452/MJES.vol55no1.6Keywords:

Diversification, firm value, GMM, ownership identityAbstract

This paper examines the mitigation effect of the ultimate ownership identity on the diversification discount under the emerging market’s institutional setting. Using a sample of non-financial listed firms in Malaysia from 2002 to 2013, the study reveals that government ultimate ownership is able to mitigate the diversification discount better than family ultimate ownership by 5 to 43 percent, whereas family ultimate ownership is better than foreign ultimate ownership in mitigating the diversification discount by 30 to 118 percent. Our study also finds that a high degree of ownership concentration gives rise to the diversification discount.