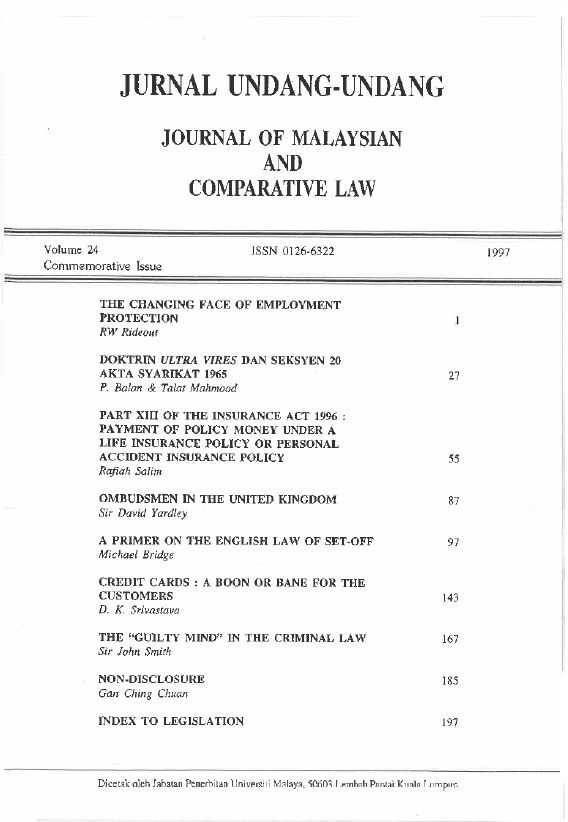

A Primer On The English Law Of Set-Off

Keywords:

insolvency, non-insolvency, set-off, common law, English lawAbstract

Set-off is the process by which a claim is reduced or eliminated upon account being taken of a cross-claim. It has the reputation of being an obscure and intimidating subject. It is also a profoundly important one, given its insolvency implications and the role it has to play in the workings of the financial markets. The integrity of the various financial markets, and of the netting agreements designed to offset the multiplicity of transactions cancelling each other out, was important enough in the United Kingdom economy to be the subject of Part VII of the Companies Act 1989. This created a type of min-insolvency process, designed to allow the rules of set-off to operate unimpeded by insolvency. Otherwise, the insolvency of one market player could have a domino effect on other players, triggering a wave of defaults and further insolvencies.

Downloads