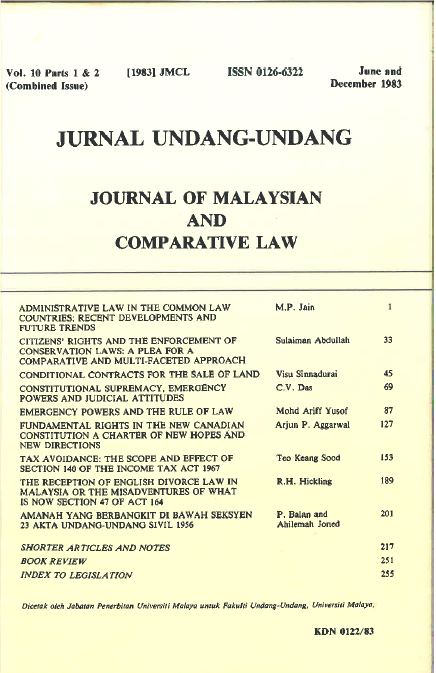

Tax Avoidance

The Scope And Effect Of Section 140 Of The Income Tax Act, 1967 (Part II)

Keywords:

bona fide dispositions, Ordinary business, family dealing, tax avoidance, the choice doctrine, mullens, transactions not at arm's length, director-generalAbstract

Although section 140 of the Malaysian Act is in some respects adequate for its general purpose, it is certainly not clear as regards the limits of its application. For instance, the characteristics a scheme or transaction must bear before it comes within the section are not clearly defined. If construed literally, the section would extend to every transaction whether voluntary or for value which has the effect of reducing the tax liability of an individual.

Downloads