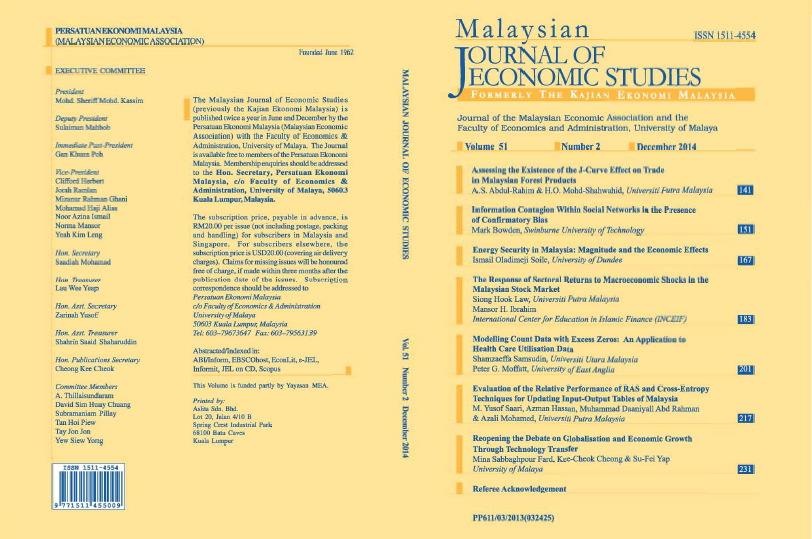

Assessing the Existence of the J-Curve Effect on Trade in Malaysian Forest Products

Keywords:

Autoregressive distributed lag approach to cointegration, exchange rate, J-curve effectAbstract

This paper examines the dynamic effect of the Malaysian exchange rate indices on bilateral trade of Malaysian forest products namely fibreboard, particle board and pulp for paper. Special attention is given to investigate the J-curve hypothesis: whether the trade balance for Malaysian forest products benefits from a decline in the value of Ringgit Malaysia (RM). We adopted the autoregressive distributed lag (ARDL) approach to cointegration to estimate the annual bilateral trade data of Malaysian forest products from 1970 to 2010 with various countries in the world. We found no evidence of the J-curve phenomenon for the trade in Malaysian forest products. The long-run analysis showed the exchange rate to be insignificant in influencing the trade balance of Malaysian forest products. This implies that there are no changes in the trade balance for fibreboard, particle board and pulp for paper trade, regardless of whether the Malaysian exchange rate depreciates or appreciates. However, income variables were found to be important factors in determining Malaysian trade, only in pulp for paper products.